Fast shipments, without intermediaries and with predictability in the equivalence. Money transfers and payments abroad. Transfer costs for ERC-20 tokens.

If there is one good thing about stablecoins, it is that their value always remains the same. This is why they are very attractive for sending value to any country, since both parties can have predictability about the equivalence of the amount they send and receive.

Each user can send their tokens to a valid address and thus transfer their stablecoins without further complications and without intermediaries.

For example, money can be sent or received between Argentina and the United States, originating and converted into pesos or dollars, using DAI, USDT or USDC. And this serves to facilitate international transactions for both natural persons and legal entities.

Any user can purchase a number of stablecoins with the fiat currency of their choice, and then transfer those stablecoins to an offshore account, where the recipient can exchange them back into fiat money.

Stablecoins allow value to be transferred to other countries in a simple way and without volatility problems.

ERC-20 transfers and tokens

Transactions of ERC-20-based stablecoins, such as DAI and USDC, have already become the largest value transfer vehicle on the Ethereum network, surpassing even ETH, the native token of that network.

The cost per transaction on Ethereum has increased significantly in recent years, as a result of the massiveness gained by its DeFi and NFT sectors. But various alternatives were appearing in blockchains whose operation allows them to lower the transaction cost, or layer 2 solutions to lower the cost of Ethereum.

All of this currently allows stablecoins pegged to the dollar to be present on various networks such as the Binance Smart Chain (which has BUSD) or Terra (TerraUSD).

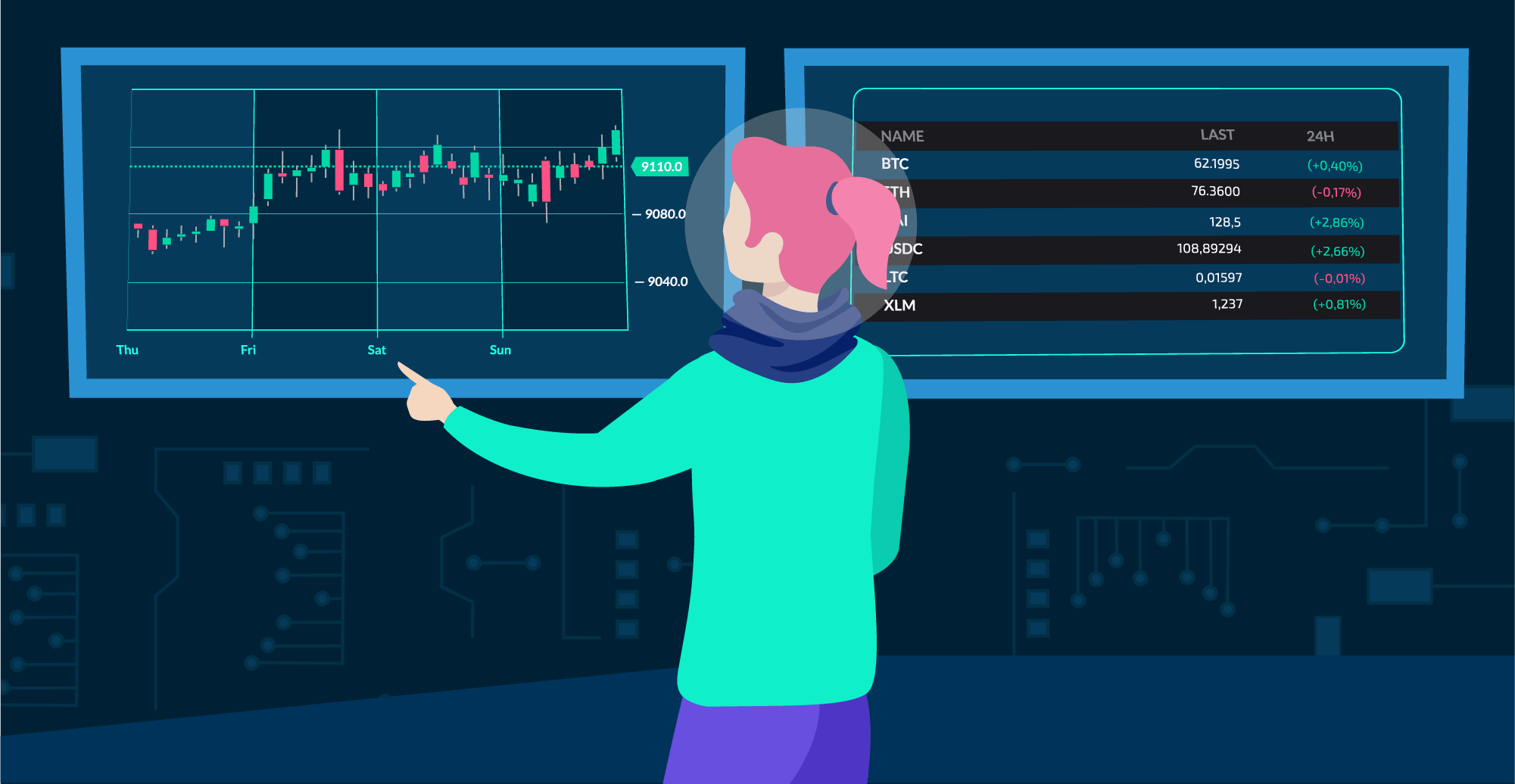

Stablecoins and trading

Exchange of stablecoins on exchanges. Stable cryptocurrencies as a pivot for the trading of digital assets. How to regulate the entry and exit price.

Las stablecoins tienen un uso bastante particular para las acciones de trading o intercambio de criptomonedas en sitios conocidos como exchanges, que son pequeños mercados de tipo bursátil pero enfocados a este tipo de activos digitales.

En el trading, el problema de la volatilidad es muy recurrente, ya que si por ejemplo una persona o empresa consolida una posición fuerte en una criptomoneda como Bitcoin, por ejemplo, todo el capital invertido en BTC estará expuesto a las alzas y bajas del mercado.

Stablecoins have a very particular use for trading or exchanging cryptocurrencies on sites known as exchanges, which are small stock-market type markets but focused on this type of digital assets.

In trading, the problem of volatility is very recurrent, since if, for example, a person or company consolidates a strong position in a cryptocurrency like Bitcoin, for example, all the capital invested in BTC will be exposed to the ups and downs of the market. .

Stablecoins reduce trading volatility and allow us to freeze the value of our portfolio.

Stablecoins allow you to “exit” trading at a price you feel comfortable with and re-enter when you see fit.

In practical terms, if BTC has a peak, the holder can convert their funds in that asset to a stablecoin, freeze the relative value in dollars, and trade again with the declining BTC, having also generated a positive difference.

As long as the money is not being used in any purchase or sale, it will remain protected from volatility by the peg of stablecoins such as DAI, USDTo USDC with the US dollar.