Warnings prior to the Yagecoin Trading Information Guide

This guide and all material or information related to it (the “Guide”) is disseminated for purely informative purposes, being only a general orientation for the subsequent use by the User and/or potential User of the products offered by YAGECOIN EXCHANGE LTD . (“Yagecoin”).

The Guide does not constitute or represent in any way any type of advice or recommendation by “Yagecoin”, and/or an investment offer and/or offer to sell, or a proposal to purchase securities or digital assets under the terms of Law 26,831 (Capital Market Law) and/or any other regulations of the Republic of Colombia.

“Yagecoin” does not make any type of representation or guarantee regarding the possibility or convenience of using them as an investment, and therefore all Users and/or potential Users are recommended to consult their tax, financial, accounting or legal advisors regarding any possible investment or operation through Ripio and/or on digital assets.

Digital assets can have a highly volatile price. In no case does Ripio make any type of representation or guarantee about the possibility or convenience of using them as an investment.

What is an investment

What to take into account when investing. The return on investment. Differences between passive investments, such as staking, and active investments, such as trading.

When we talk about investments we are referring to those operations of purchasing some type of asset in order to obtain more money than the initial amount at the time of selling it.

But not all investments are the same: factors such as time, available money and the risk taken are determining factors when operating.

In this guide we will talk specifically about investing in cryptocurrencies. But first we must review some basic concepts.

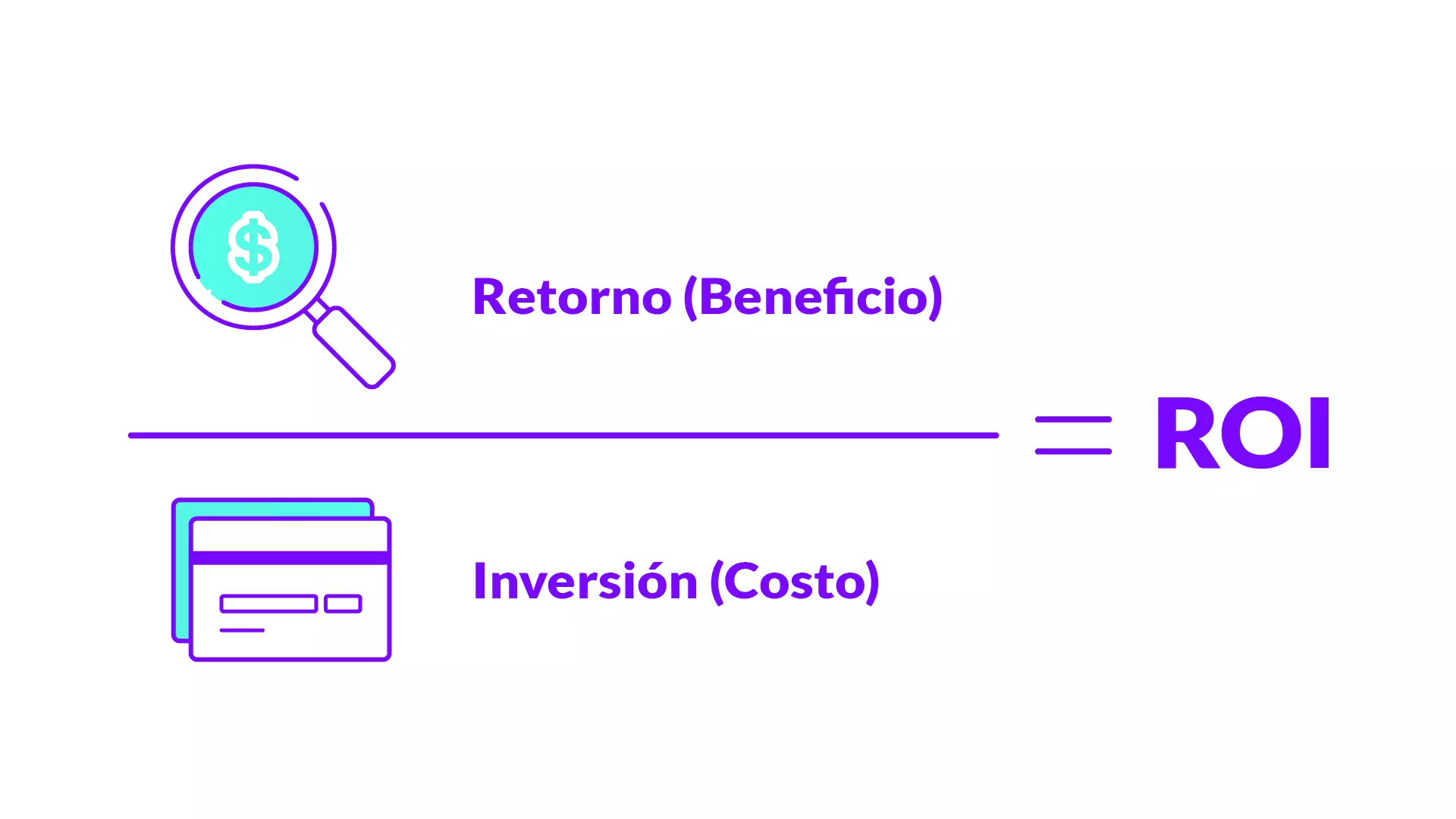

Return on investment

Return on investment or ROI (return on investment) is the percentage of money earned by an investor with respect to what was invested in an asset.

Suppose an investor buys 0.1 BTC for $1000. And after a month that 0.1 goes up to $2,000. In that case, the ROI was 100 percent monthly. If that 0.1 BTC valued at $1,500, in that case the ROI would be 50 percent.

Keep in mind that the ROI is always calculated with respect to a period of time, and that depending on how that segment is chosen, it may give one number or another.

Return on investment is a central element to take into account when deciding where, how and how much to invest.

Passive and active investments

Passive investments are those in which the user does not have to take any action to obtain a benefit. Within these tools we find, for example, bank fixed terms. Or in the crypto ecosystem, staking.

Staking is an investment in which a certain amount of tokens are immobilized on a crypto platform, exchange or service. And, in exchange, every day you get a return with a percentage in that same cryptocurrency, a kind of interest.

Instead, active investing refers to when an investor takes actions to make a profit.

Trading is the most paradigmatic case of active investment: the trader constantly makes purchases and sales to obtain profits. The return can be much greater, but the time spent and the risk assumed are also greater.

Risk and scams

What is risk in investments and how it works. How can this risk be mitigated? How to avoid the most common cryptocurrency scams.

We can define risk as the possibility that an investment portfolio will not meet financial objectives. This is, in short, making operations that make the investor lose money, or not gain anything.

By portfolio we refer to the set of financial tools or instruments of a certain user or institution. A portfolio is the sum of every stock, bond, currency and derivatives that a person or company has in their possession.

In the case of the crypto investor, the portfolio is made up of each cryptocurrency or token they own.

How risk works

Generally speaking, the greater the possibility of profit, the greater the risk associated with that investment.

Let’s think for a few seconds about two different digital assets, such as Bitcoin and DAI. Bitcoin is a very risky asset, given the volatility of its price, but it allows for great profits. DAI, on the other hand, is an asset with very low risk but whose return is almost zero.

There are several risks to consider when putting together an investment portfolio. The first is inherent to the market itself: since cryptocurrencies determine their value by supply and demand, without any intervention, the rises and falls are marked by buying and selling trends.

For example, if all holders of a cryptocurrency wanted to sell all their units at any cost, the price would plummet.

In general terms, when investing in the search for better returns you must be willing to take high risks.

This brings us to the next risk, associated with having investments in only one type of asset. If we do it and it depreciates, we will lose our money. On the other hand, if we diversify our portfolio, we will better protect ourselves against risk.

There is another type of risk associated with liquidity, and it has to do with the market volume of each asset. If an investor buys an asset but its market is so small that no one wants to buy it, they will have to sell it at a lower price in order to recover some money.

Finally, there is a risk associated with the ability of each investor to “hold the position”, to continue holding an investment over time. Sometimes, unforeseen events force us to dismantle our portfolio to have cash. And if this unforeseen event happens during a bear market, we will have lost money.

How to mitigate risk

The fundamental thing when it comes to understanding risk is to assume that it is an intrinsic variable in any investment. Therefore, we should never take on more risk than we are willing to bear.

A good option to manage risk is to diversify the portfolio in different types of cryptocurrencies. We can have, on the one hand, risky assets such as bitcoins and, on the other, low-risk stablecoins such as USD Coin, USD Tether or DAI, whose price is always equivalent to that of 1 US dollar.

Taking into account the possibility of unforeseen events happening is also a way to mitigate risk. Instead of investing all of our savings, we can set aside a portion for unexpected events and only use the money we won’t need for investments.

Another important variable may be the term: perhaps we are willing to put together a portfolio for a period of one month, two months, six months or a year. Being clear in advance about the horizon of our investments is also a way to mitigate risk.

Identify possible scams

It is known that the crypto ecosystem, being unregulated, is fertile ground for those who want to take advantage of the disbelief of others. The scams vary in scope and apparent seriousness. They can even be camouflaged as credible projects backed by “trustworthy” people and members of the ecosystem itself.

The first thing to do is read the white paper of each project and see if it holds up right there. If you have clear concepts and fundamentals, if you know how it is going to be mined, how it is going to be distributed initially, what the token creation mechanisms are, what the total amount of circulation is.

Additionally, as far as possible, it is advisable to research the project’s code: if it is published or if it will be published, if it will be audited, if it has a community of programmers. The same with the project roadmap: if each new launch is possible, if it has a chance of being realized.

Finally, you can resort to the opinion of specialized sites, such as some crypto news portals. But while this information is good and complementary, it never replaces the need to do your own research.

If you are interested in better protecting yourself when using crypto, you can review these security tips for moving around the web3.

How to put together a portfolio

Steps to know your investor profile and build a portfolio tailored to you. Differences between conservative, moderate and aggressive investors.

While in traditional finance we usually use an investment agent, a bank or a stockbroker, the best option in the world of cryptocurrencies is to build our own portfolio.

This will allow us to choose the investment term, the risk to assume and the amount of money to invest in a certain asset.

After identifying our needs and possibilities, we have to set up our accounts on each platform or exchange; and also create our respective wallets for each cryptocurrency. Once we have that ready, we can start investing.

It is always advisable not to delegate control of our cryptocurrencies to third parties that offer us attractive short-term returns. As a general rule, these are usually scams known as ponzi schemes.

When investing, take into account your possibilities, your experience and how exposed you may be to losing your funds.

What is an investor profile

The investor profile is usually a way of encompassing a large part of investors into categories, based on certain parameters such as age, knowledge of the financial market, predisposition to risk, ability to assume losses and investment time.

Based on these criteria, investor profiles are usually created for people (or companies) with a low, medium or high predisposition to take risks. In general, these criteria are related to the expectation of profit, the amount to invest and the term.

A person who wants to maximize the return on their savings but without being exposed to losing them is not the same as an institutional investor such as a company that wants to make a customized OTC (over the counter) operation.

Many financial institutions, such as banks, have standardized forms to determine the profile of each investor and help you adapt your investments to your profile.

Trading: what it is and what types there are

What does asset trading as an investment consist of? Main differences between scalping, day trading, swing trading and position trading methods.

Trading is, basically, a tool to multiply our capital. Although it is a complex technique, it starts from a very basic foundation: buy low and sell high.

Trading, as its name indicates, is the constant exchange (trade) of assets to add value to a portfolio, and its principle is to buy an asset at one price and then sell it at a more expensive price to obtain a profit.

The ways of trading are diverse, and depend among other things on the time available to each investor.

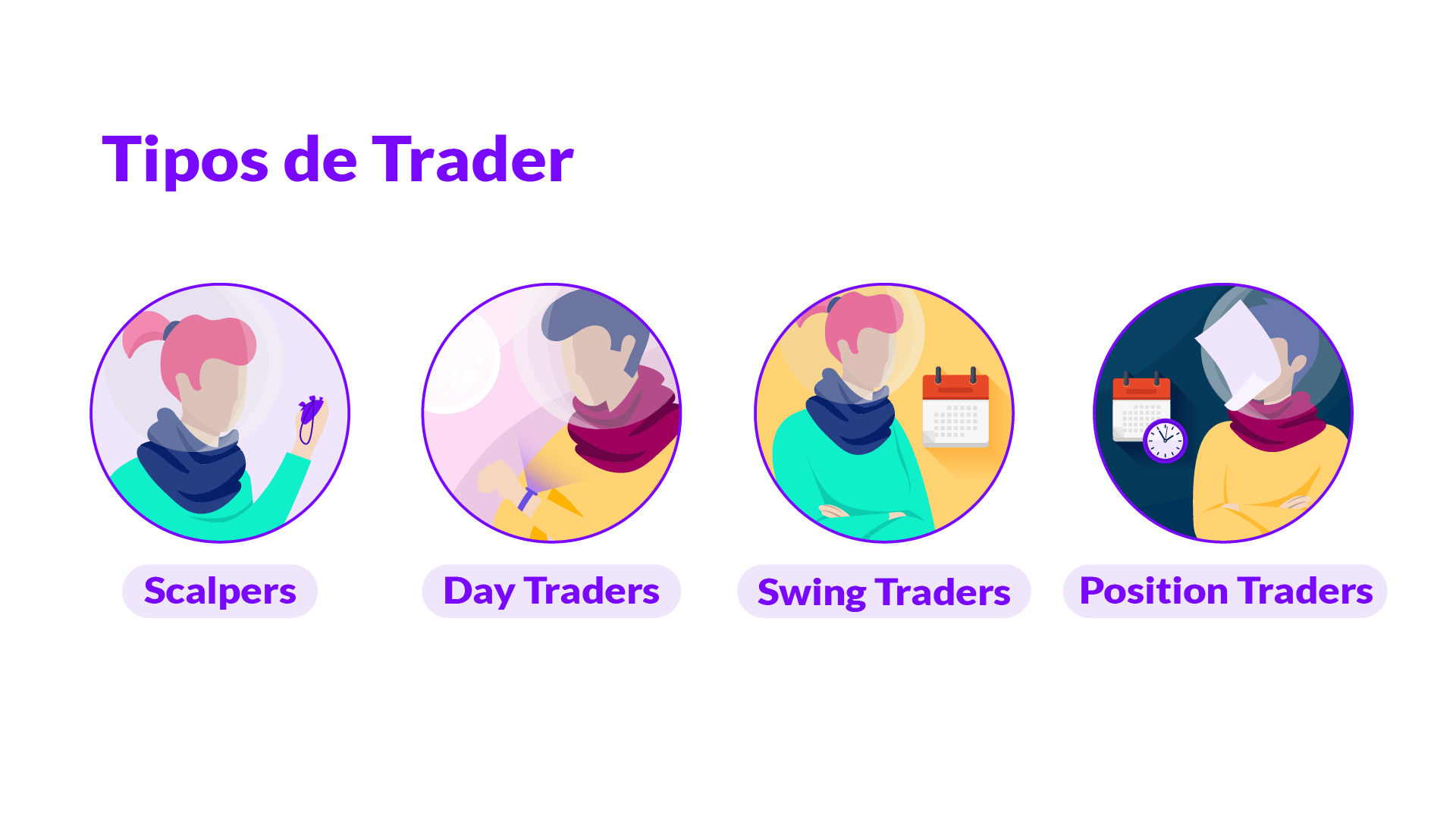

Scalping

Those who use this intraday trading technique buy assets and hold them for only a few hours, minutes or just seconds, and then close a sale operation. These traders are not looking for a few points but for a trend rise. And as soon as they ride the wave, they close the operation and sell. They are, therefore, very short-term traders, who carry out many operations in the day and have a very small return for each one.

Daytrading

In interday trading, trades are also carried out on the same day, but traders take a few hours before closing them. Nor is it that they wait until the next day to see the fruit of the operation: as they usually have open positions in one or more instruments whose prices can fall at any time, they aim to close all negotiations on the same day.

Swing trading

This style of trading is for those who are more patient in their operations and wait a few days until the trend in the market reaches the desired point. It requires peace of mind and confidence in choosing what to invest, since the trader will not always be connected. It is also necessary to stay calm even if the market does not show the desired process in the short term, and keep the process open even for a few weeks if necessary. If you are impatient, it is not recommended that you choose this method.

Position trading

Long-term position trading is a trading style where it can take months or even years to close the trade. Of all the methods, it is the one that requires the greatest coldness and the ability to ignore external opinions about market trends, thus leaving positions open while waiting for the best opportunity to close.