DAI, the MakerDAO token mounted on the Ethereum network. Regulation of parity and compensation mechanisms in DAI through smart contracts.

DAI is a token mounted on the Ethereum network whose value is always maintained at 1 to 1 parity with the US dollar. From there it receives the label of stablecoin, stable cryptocurrency or cryptodollar.

Like any other cryptocurrency, DAI can be used to transfer value, save, or make payments.

DAI works with Ethereum’s ERC-20 protocol, which allows the creation of fungible tokens (i.e. exchangeable).

This allows all tokens to be equal while allowing any wallet connected to the Ethereum network to support DAI.

To create DAI it is necessary to immobilize another cryptocurrency, which remains under the custody of the smart contract to guarantee the value of the DAI.

If someone wants to obtain 100 DAI through the Maker protocol, they would have to leave the equivalent amount of ETH in the corresponding contract address, based on the current price.

As of March 2022, ETH is moving around $3,000. So if someone wants to get 100 DAI ($100), they must leave a sum close to 0.033 ETH. If you want to recover that ETH, you should return the corresponding amount of DAI.

DAI is a stable cryptocurrency born from Maker, and whose price is regulated by a smart contract.

Regulation of parity in DAI

The characteristic that distinguishes DAI from other stablecoins is that it uses a clearing mechanism for its value, in which no central organization is involved.

Instead, it is regulated by a smart contract that already has all the variables that allow it to function written from its origin.

Thus, users can be sure of what the network’s behavior will be as determined by the context, but without intervention by people, companies or governments.

Under scheduled compensation, if the price of DAI falls below the dollar, users are rewarded for holding their DAI through an interest rate, plus the cost of creating new DAI increases. In this way, issuance is discouraged, scarcity is created and the price rises again.

If the price of DAI exceeds the dollar, the reverse process occurs. The creation of new DAIs becomes cheaper and the compensation rate is lowered, which stimulates the creation of DAIs and lowers the price.

However, those who do not participate in the Maker protocol can also purchase DAI from crypto platforms such as Yagecoin, without any prerequisites or having to worry about these compensation mechanisms.

The USDC model

USD Coin, the Center token, the union of Circle and Coinbase. Regulation of parity with reserves based on dollars and bonds. External audits in USDC.

USDC is another token mounted on the Ethereum network whose value is maintained at 1 to 1 parity with the US dollar, and which therefore falls into the category of stablecoin, stable cryptocurrency or cryptodollar.

Like any other cryptocurrency, USDC can be used to transfer value, save, or make payments.

USDC is powered by Ethereum’s ERC-20 protocol, which allows the creation of fungible (i.e. exchangeable) tokens.

This allows all tokens to be equal while allowing any wallet connected to the Ethereum network to support USDC.

USDC, Centre’s stablecoin, has reserves in dollars and bonds that are permanently audited.

Regulation of parity in USDC

To maintain its parity with the dollar, this stable cryptocurrency has a reserve of fiat money. The large part is in dollars and short-term US treasury bonds.

USDC arises from the company Circle, which is part of the Center consortium. But to ensure that reserves are equivalent to the number of tokens in circulation, USDC is audited by a third-party company that publishes regular reports on the status of its accounts.

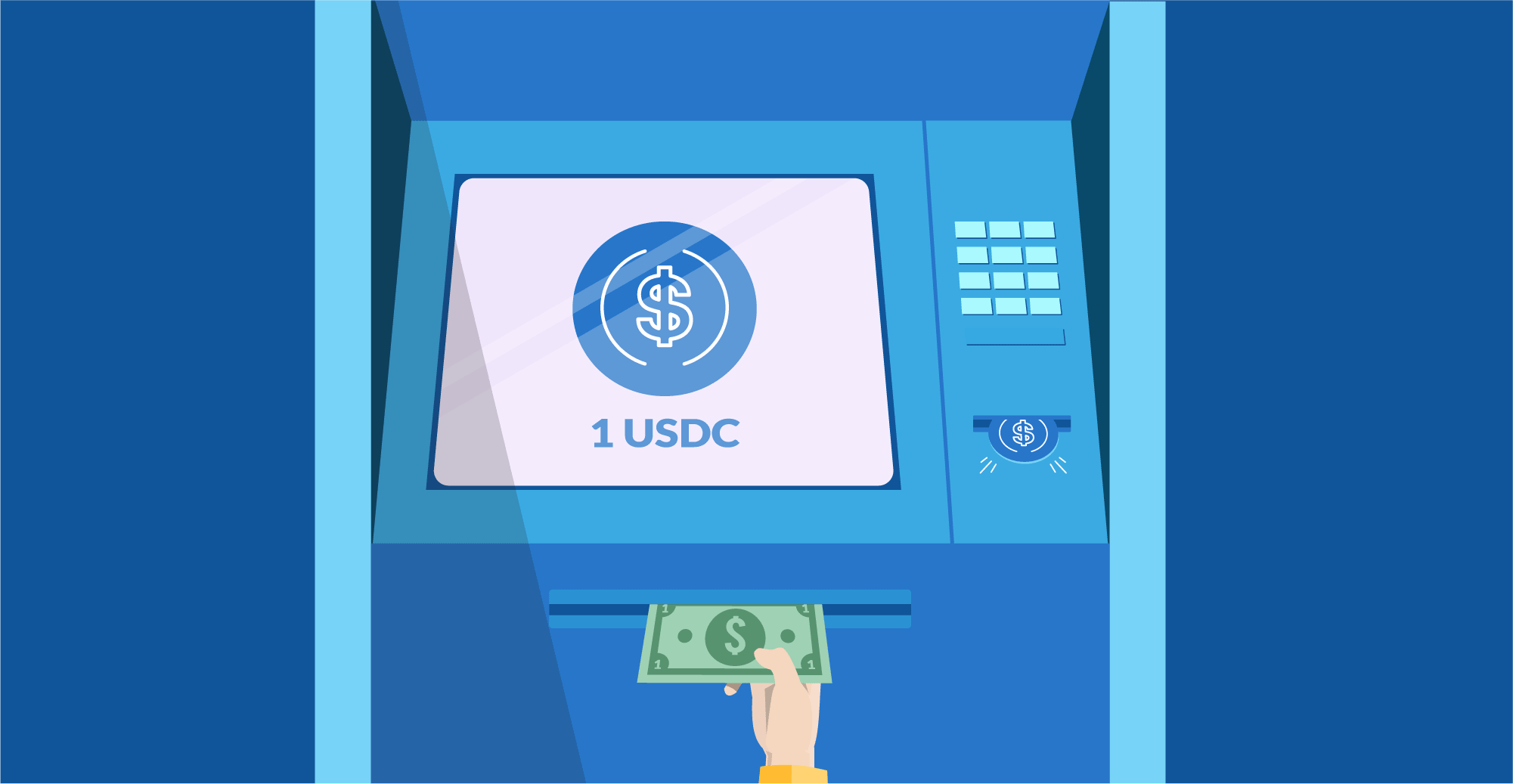

USDC provides a mechanism that allows the token to be exchanged directly for dollars that are transferred to the user’s account. This service works directly from the Coinbase app, and is now available in 85 countries, including Argentina.

However, it is possible to buy USDC from platforms like Ripio, without any type of prerequisite, from Colombia and in pesos.

The USDT model

USD Coin, the Center token, the union of Circle and Coinbase. Regulation of parity with reserves based on dollars and bonds. External audits in USDC.

USDT is a stablecoin built on the Bitcoin network whose value is maintained at 1 to 1 parity with the US dollar, and which therefore falls into the category of stablecoin, stable cryptocurrency or cryptodollar.

Like any other cryptocurrency, USDT can be used to transfer value, save, or make payments.

USDT is powered by the OmniLayer protocol, a layer 2 project for Bitcoin that allows the creation of fungible tokens (i.e. exchangeable and equivalent).

At the same time, this stablecoin is also operational on the Ethereum and TRON networks.

USDT parity regulation

To maintain its parity with the dollar, this stable cryptocurrency has a reserve of fiat money.

USDT arises from the company Tether Limited, which, due to some transparency problems in the past, began to operate with sporadic audits. In August 2021, it was audited that Tether did indeed have sufficient coverage assets to finance its issuance.

USD Tether is not a cryptocurrency that can be mined. The issuance is carried out by depositing fiat dollars in the company’s accounts, which in return delivers the equivalent in its USDT cryptocurrency.

However, it is also possible to buy USDT from platforms like Yagecoin, without any type of prerequisite, from Colombia and in pesos.

How to collect stablecoins

Exchange of stable cryptocurrencies for fiat money. Sale on platforms. Trading between peers. The DAI, USD Coin and USD Tether exchange systems.

To exchange stablecoins for fiat money, users have different options: they can sell their cryptocurrencies to a platform like Ripio, to other users, or redeem them directly on the platform where they were created.

Sale on platforms

The most common method is to sell those tokens on a platform with cryptocurrency buying and selling functions, which in that sense works as a cryptocurrency “exchange house.”

In this case, the user adapts to the price at which the service pays for each stablecoin, with the advantage that they usually work at all times and with simple and fast operations, in addition to offering technical advice if necessary.

Trading between people

Users can choose to sell their stablecoins to other users, without any intermediary. This way is known as person-to-person or P2P (peer to peer).

The advantage of this method is that the price is decided by both parties to the transaction, so the seller can sometimes get better prices than on a centralized platform. The disadvantage is that you must find someone interested in purchasing those stablecoins, and that it can be an unsafe process if you don’t know the other person.

There are many ways to convert stablecoins to other cryptocurrencies, fiat money, or other assets.

The USDC system

USDC allows an additional way to exchange your tokens for fiat money: this requires having an account on the Coinbase platform, the company that created USD Coin, where tokens can be exchanged directly for dollars that will be deposited into the user’s account.

Then, using functionality available in 85 countries, that balance can be transferred to a bank account.

The DAI system

This option does not exist for DAI, since it works on a smart contract that makes it a decentralized system, without any type of company that “backs” those tokens.

On the Maker crypto platform, however, those who have used ETH as DAI can recover those tokens in exchange for returning the equivalent sum of DAI first.

The USDT system

During its early years, the Tether Ltd. crypto stable generated some controversies due to its centralized model, where much of the information about its operation was hidden from view; and also to maintain close relationships with some exchanges where most of USDT was traded.

However, with the growth of the ecosystem and the emergence of more and more buying and selling platforms and wallets, as well as decentralized DeFi exchanges, there are currently a variety of options to exchange USDT for other cryptocurrencies and tokens or convert it to fiat money.