Distributed services and decentralized stablecoins. The consensus between participants. User control over their economy.

Without a doubt, one of the most significant aspects of Ethereum is the network’s ability to create decentralized services on its structure. The potential is enormous.

Let’s imagine, for a moment, a bank that was not controlled by any company or government, where the financial mechanisms are automated by smart contracts and the rules are built through consensus between participants.

In this way we could acquire all the advantages of a banking system (security, credit, interoperability), but in a community run by its users.

Something very similar to this happens with the DAI protocol, which allows the creation of a stable currency detached from the commitments of a state or a central bank. In addition, DAI is controlled through the active participation of its members from the MakerDAO platform, which allows consensus to be created on how its protocol should be governed.

Decentralizing value allows people to take control of their economy and access financial solutions.

The decentralization of value, beyond being a slogan or an idea behind a technology, is the real potential for people to regain control of their economy and various aspects of the social economy.

From minting currency to creating digital collectible objects. Or as has been happening recently with the DeFi movement, which managed to replicate some of the functionalities of the financial system with decentralized technologies.

All this with the only requirement of having a phone and an internet connection. Therefore, the disruptive potential in economies where the population is not banked is even greater.

Ethereum’s potential in this regard is only limited by the creativity and capacity of its community.

Tokenization of the economy

Transformation of goods and services into digital assets. Types of tokens. The case of the Basic Attention Token (BAT)

Another aspect that may seem copied from a science fiction novel is tokenization; that is, the ability to transform goods or services into digital assets (tokens).

The range is very wide, and that is why there are even categories within the tokens that can be created: utility token, security tokens and currency tokens, to name a few. Tokenization

Basically, each of these categories defines a different type of tokenizable assets. And yes, almost everything can be tokenized.

Tokens allow goods and services to be converted or represented into safer and more malleable digital assets.

Let’s take, for example, BAT (Basic Attention Token), a token associated with Brave, a web browser that blocks any advertising by default, saving users time and data.

At the same time, it has its own advertising system. Those companies that want to use it must pay, and users who choose to see these advertisements receive a monthly sum of BAT in exchange.

Furthermore, as BAT is created under the ERC-20 protocol of Ethereum, it is interoperable with all the services of that blockchain. That is, you can deposit your BAT in a DeFi service and receive interest in return.

In this way, something as abstract as the “attention” of users became a token and gave rise to a small economy.

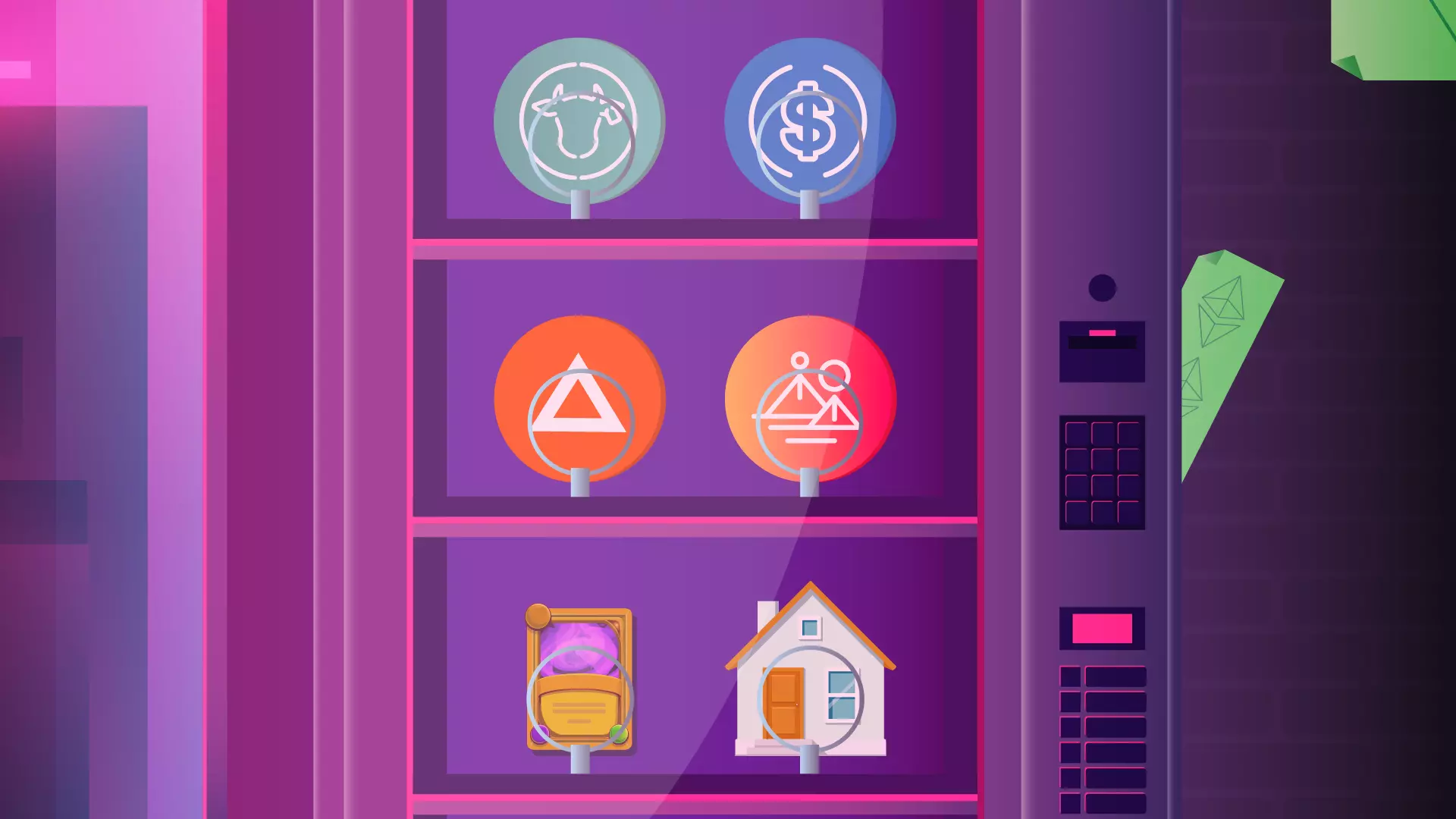

Tokenization has no limits, which is why there are already tokens that represent cows (Bitcow), gold (PaxGold), digital trading cards (Gods Unchained), dollars (DAI, USDC), digital land plots (Decentraland) and even tokens that represent other tokens (WBTC, WETH, tBTC).

Ethereum-based projects

Scams, the final warning. Success stories in the Ethereum blockchain: video games, crypto dollars, tokens and DeFi projects.

Successful Ethereum-based projects

Decentraland: virtual reality video game with its own token (mana) and sale of virtual land.

Gods Unchained: digital trading card video game.

CryptoKitties: video game that allows you to collect and raise virtual kittens.

DAI: DAI is a stablecoin with 1 to 1 parity with the US dollar, and Maker is its governance platform (which also has its own token, MKR).

USDC: stable cryptocurrency with 1 to 1 parity with the US dollar.

BAT: token given to users of the Brave browser in exchange for viewing online advertising.

Uniswap: decentralized exchange that allows cryptocurrencies to be exchanged without an order book, but with a new system called liquidity pools. It was one of the fastest growing DeFi projects in 2020.

Compound: protocol that allows creating interest rates for those who hold certain cryptocurrencies.