When purchasing cryptocurrency, as an investment or for any purpose, there is no one way. In fact, each method has its advantages and disadvantages.

Between peers

Those who prefer to make transactions without intermediaries can opt for the “person-to-person”, “peer-to-peer” or P2P system. In this type of markets, the price is determined by the users and the platforms only play the role of connecting buyers with sellers.

P2P markets can range from Facebook, Telegram or Discord groups to specialized pages. Although it is a model that involves some risk, since by not knowing our counterparty we can be exposed to scams.

In addition, it requires the use of cash and, in general, the transfer to a common place to meet the other party.

P2P operations eliminate intermediaries, but involve risks if the other person is not known.

Online platforms

Another model is that of online platforms, which is one of the most widespread. There, the platform is the one who buys or sells cryptocurrencies, at a price that it determines. Such is the case of Ripio. This method of buying and selling coins is very simple, but it limits the possibilities of bidding on the purchase price.

On the other hand, this model is usually quite secure (if you operate on the leading services), plus it usually offers technical service and advice, and allows you to operate comfortably without traveling or having to deal with strangers.

The brokers work at all times, with very simple interfaces and the reliability of the platforms.

Exchanges

Finally there are exchanges, trading platforms that may or may not be centralized. Although almost all of them work in the same way, they have their differences and particularities: the cryptocurrencies they offer, the possibility of operating with leverage (taking loans to make an investment), of operating in the future, of staking (leaving a certain amount of crypto in exchange of a return) or operating with fiat money.

One of the clearest differences is the number of cryptocurrencies listed on each exchange, which depends on several issues. Firstly, because before adding them, each exchange subjects them to an audit. It also happens that many do not have enough liquidity.

Each exchange has a different list of cryptocurrencies, and also different values and fees.

On the other hand, the prices of each cryptocurrency tend to be different in each exchange, as well as the commissions per operation, for transferring money to fund the account or for sending crypto.

All this must be taken into account when choosing a trading platform to know if, even after deducting the commissions, we earned or lost money.

Exchange elements

Base and quote currency pairs. Order books, market type orders and limit type orders. Makers and takers, the participants in the crypto market.

The pairs

A pair is the quote of two different currencies. The first is called the base currency, and the second is the quote currency. For example, in the BTC/DAI pair, the base currency is bitcoin and the quote currency is the DAI token. Knowing the movement of a certain pair over time is a good strategy for trading.

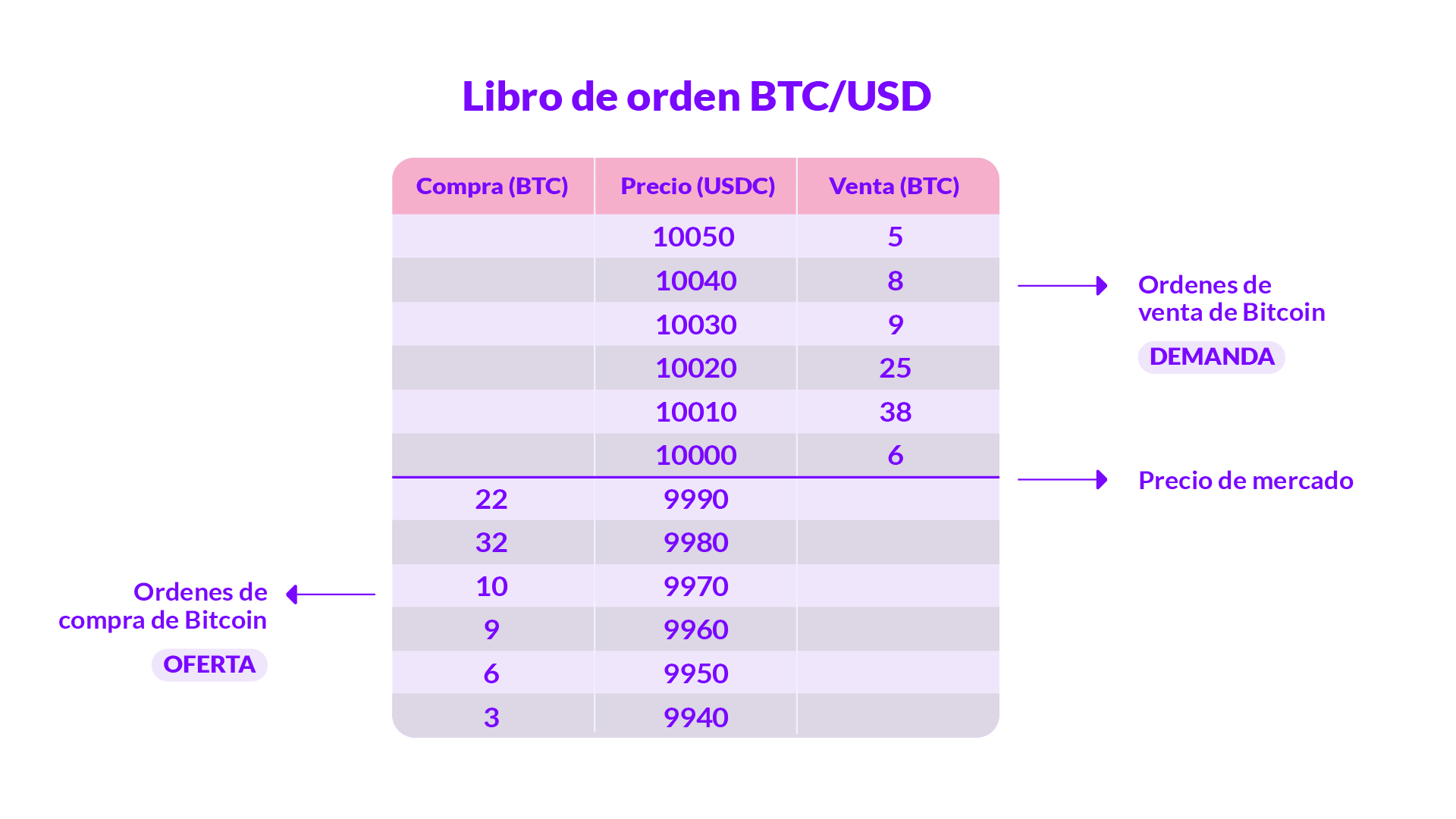

The order books

An order book is a public listing of buy and sell orders created by users of an exchange. Generally, sell orders are displayed at the top and buy orders are displayed at the bottom.

The sales order closest to the center is called the selling point. And to the shopping center closest to the center, purchasing point. When both match, a match occurs. This means that the price and sales conditions proposed by one user correspond to the price and purchase conditions expected by another user. That is where the trade occurs.

Order books bring together the sales intentions of certain users with the purchase intentions of others.

Market type orders

Market type orders are adjusted to the average market price for the chosen pair. For this, we simply have to complete the “amount” field. That is, you only need to indicate how much of the base currency we want to buy or sell.

This type of order prioritizes that the operation be carried out as soon as possible, taking the last published orders regardless of the price, until the total amount of our order is completed.

Limit orders

To create a limit order we must complete three fields: the price at which we want to pay 1 unit of the base currency, expressed in the quote currency; the amount or number of units desired; and the total or maximum quote currency willing to exchange for the desired amount of base currency. This type of orders allows you to play a little more with the factors and values of the cryptocurrency market.

There are several other order types, and not all of them are available on all exchanges, but market and limit are the simplest to start trading. There are also others, such as stop market orders, which are executed when the selected asset reaches a certain price.

Takers and makers

In the crypto market there are two classes of participants. Those who create the supply in the market, known as makers and in charge of providing liquidity to the market; and those who keep that offer, called takers, who subtract liquidity from the market but add operating volume.

How to trade on an exchange

January 29, 2021

A detailed explanation with everything you need and all the steps you will have to follow to be able to operate on the Yagecoin exchange.

We accompany you step by step with instructions to make your first trade, taking the yagecoin exchange as an example.

- Luego de analizar el mercado y proyectar tu portafolio tenés que crear y validar tu cuenta en el exchange.

- El siguiente paso es fondear la cuenta en cuestión. En Ripio, por ejemplo, tenés dos cuentas para cada moneda: una para la wallet y otra independiente para el exchange.

- Para poder tradear en el exchange, debés tener fondos disponibles en esa cuenta. Para esto, podés transferir desde tu yagecoin Wallet hacia tu cuenta de yagecoin Exchange. La transferencia de fondos entre estas plataformas no tiene costo y es inmediata.

- Ahora tenés que elegir un par. Puede ser BTC/DAI, ETH/DAI, BTC/ETH, BTC/USDC, el que necesites.

- Luego vas a elegir el tipo de orden (market o limit) y señalar que es de compra (o, en el momento que desees vender, de venta).

- Finalmente, ingresá el precio y, de ser necesario, el monto y el total máximo.

- ¡Listo! Una vez ejecutada la orden, podés seguir haciendo trading con tu nuevo activo o bien retirarlo como fondos para tu yagecoin Wallet.

Si te interesa conocer más a fondo cómo usar el exchange de Yagecoin, te recomendamos este tutorial.

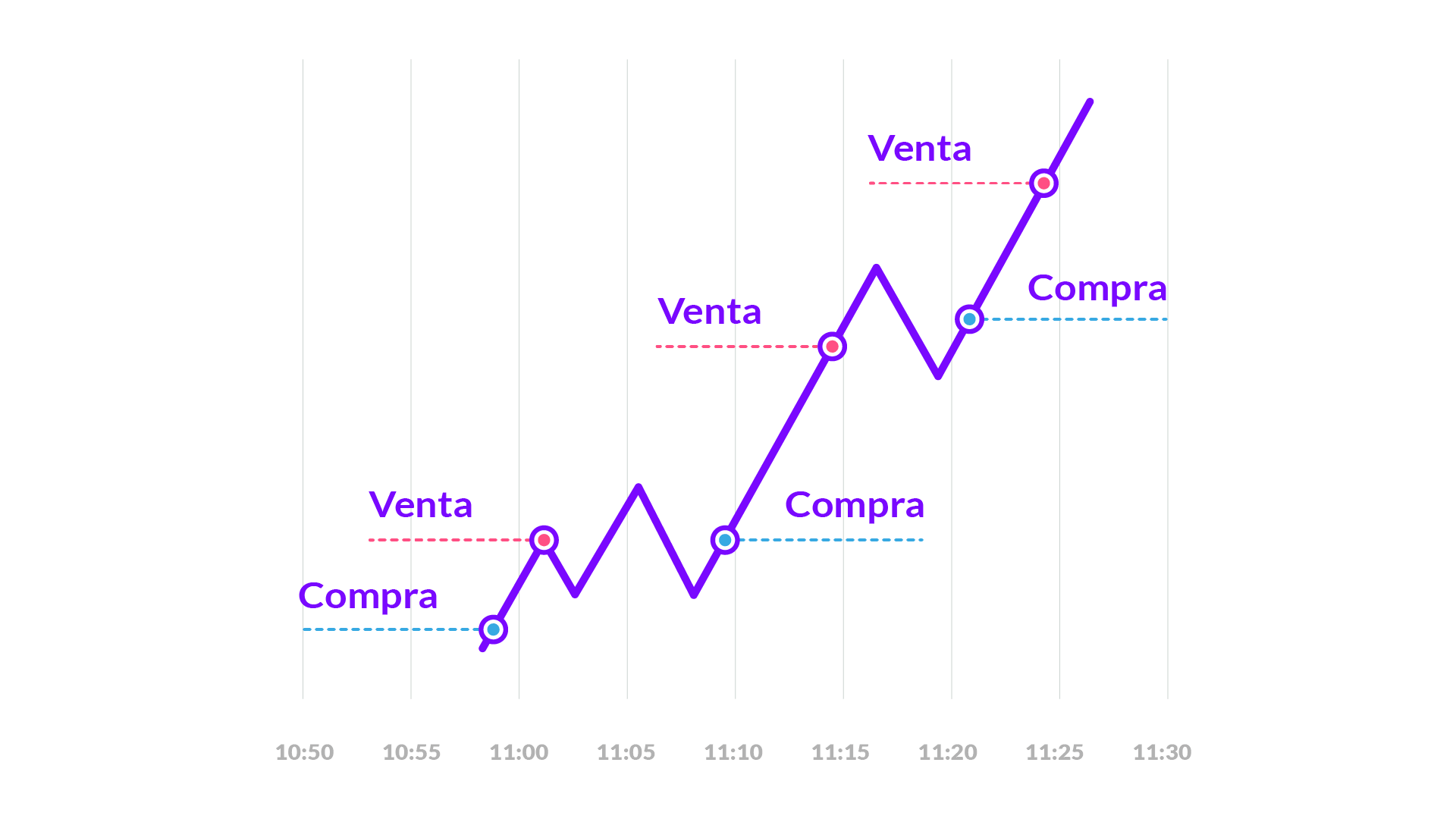

When trading on exchanges, remember that the goal is always to sell at a better price than what you bought.

After analyzing the market and projecting your portfolio, you have to create and validate your account on the exchange.

The next step is to fund the account in question. In Ripio, for example, you have two accounts for each currency: one for the wallet and another independent one for the exchange.

In order to trade on the exchange, you must have funds available in that account. For this, you can transfer from your yagecoin Wallet to your yagecoin Exchange account. The transfer of funds between these platforms is free and immediate.

Now you have to choose a pair. It can be BTC/DAI, ETH/DAI, BTC/ETH, BTC/USDC, whatever you need.

Then you are going to choose the type of order (market or limit) and indicate that it is a buy (or, at the time you want to sell, a sell).

Finally, enter the price and, if necessary, the amount and maximum total.

ready! Once the order is executed, you can continue trading your new asset or withdraw it as funds for your yagecoin Wallet.

If you are interested in learning more about how to use the Yagecoin exchange, we recommend this tutorial.