Particularities of investments with digital assets. Initial cryptocurrency offerings. Centralized, decentralized finance and yield farming.

Investing in cryptocurrencies is one of the many tools available within the world of digital financial assets, but it has very specific characteristics.

It is a market that remains active 24 hours a day, 365 days a year, and does not have intermediaries, stock agents or permits necessary to operate, but rather each person can manage their own portfolio.

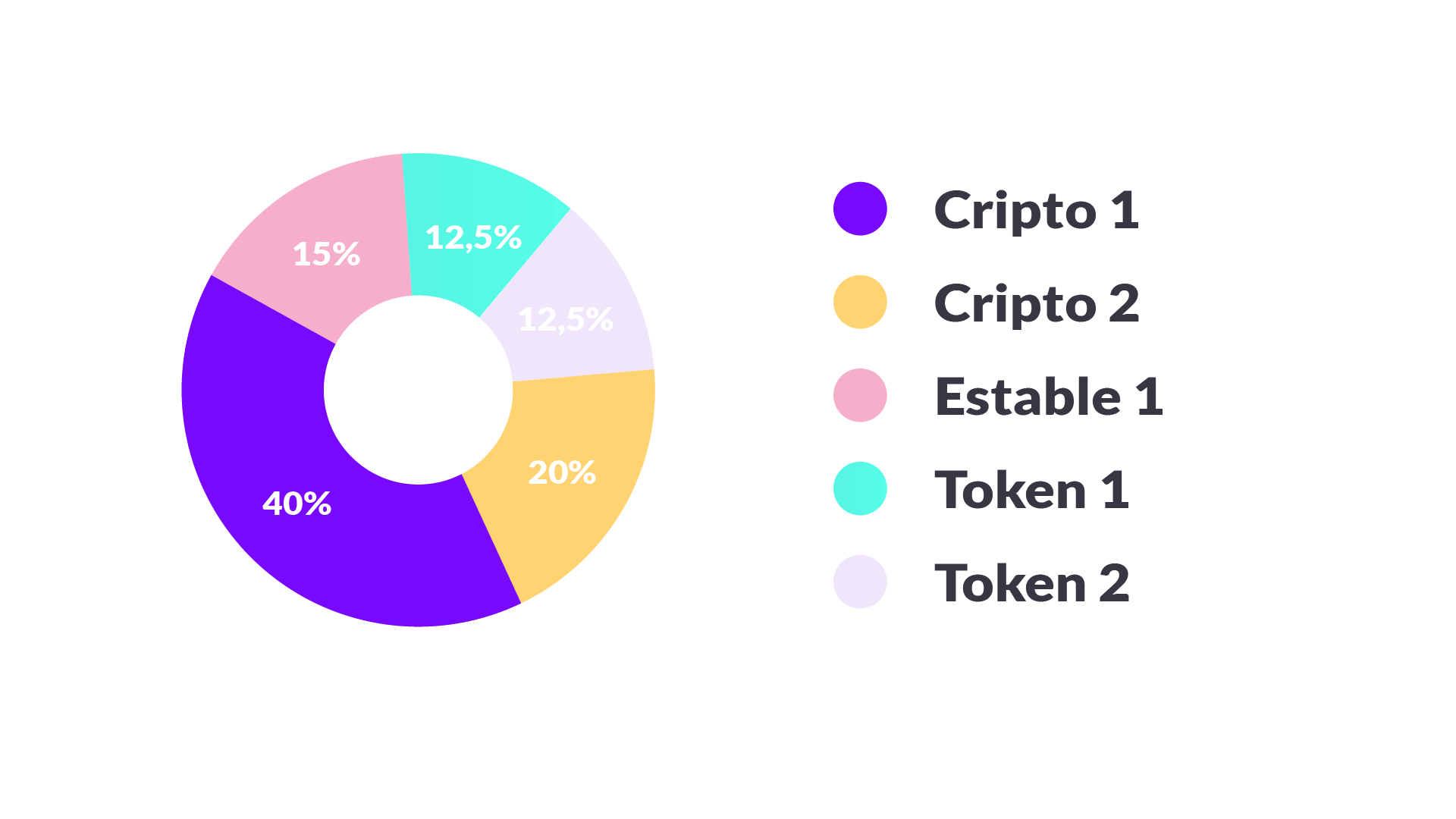

On the other hand, it is made up of assets with very different characteristics. Some are low risk like stablecoins and others are high risk like bitcoin. Therefore, the main thing when investing in cryptocurrencies is to educate yourself about them, research and draw your own conclusions.

In previous guides in this Launchpad we already reviewed some types of assets in the crypto world, such as Bitcoin, Ethereum and the stablecoins DAI, USDC and USDT. We recommend taking a look at them to have a complete overview of each project, and understand their strengths and weaknesses.

In any case, to start trading the first thing is to go from fiat money to cryptocurrencies, which you can easily do in Ripio. And the second, choose a trading platform, whether it is a classic exchange (centralized) or a decentralized one.

Among digital assets there are some low risk, such as stablecoins, and others high risk, such as Bitcoin.

ICO, initial currency offerings

This type of investment, the initial coin offering or ICO, was very common a few years ago, but was largely neglected. It is a modality very similar to IPOs (initial public offering), the mechanism that companies use when they launch their own stock on the market.

In ICOs, each cryptocurrency project offers a pre-sale of its token, with the aim of financing said project. In case it is successful, the price will increase above the pre-sale value.

Ethereum was the main development financed, in part, with this modality, and then a lot of projects emerged that copied the modality. Many never even came to fruition, and several turned out to be scams. That is why it is advisable, as we always suggest, to thoroughly investigate each project.

Passive investments with cryptocurrencies

One type of passive investment is CeFi, the centralized finance model through which users can deposit their cryptocurrencies on a platform offered by a company to obtain a return (annual but with daily settlement) in exchange.

Another type of passive investments are DeFi, the decentralized finance model: a set of financial services that work on smart contracts, avoiding human intermediation and centralization in the process. This model was the most vibrant space for innovation in the world of cryptocurrencies during 2020, and has a moderate complexity that we cover in this article. And if you want to go deeper, you can review our DeFi Guide.

If you want to know more about CeFi, DeFi and their possibilities, don’t worry: we dedicate an entire chapter to them in this same guide to discuss them in depth.

Brokers, wallets and exchanges

January 29, 2021

Platforms to operate and invest in cryptocurrencies. Characteristics of brokers, exchanges and the different ways of managing crypto wallets.

In order to invest in cryptocurrencies, it is necessary to have accounts on different platforms that make operations possible.

Platforms and wallets

One of the simplest and most well-known models to buy and invest in cryptocurrencies are the formerly called brokers, which have evolved in some cases to become platforms for acquiring crypto with fiat money, but which also offer other functionalities.

The procedure to operate on these platforms, as is the case with Ripio, is quite simple. First, money is transferred or loaded into the account to purchase the desired currency, which is credited to our wallet. On the same platform, you can also sell crypto in exchange for fiat money.

In these services, the buying and selling prices are set by the platform, as happens in a foreign currency exchange house. Users cannot choose a different price and, therefore, trading success is subject to stronger increases in each asset. The thing is that you must not only earn a margin but also overcome the spread, which is the difference between the sale price and the purchase price of a certain asset on that platform.

Various tools and platforms come into play when trading and storing digital assets.

Exchanges

They are the most popular trading sites, and function as small asset exchanges dedicated to the buying and selling of cryptocurrencies.

On an exchange, users can create orders, which consist of the quantity and price at which they want to buy or sell a certain asset. When that order finds one or more users who can satisfy it, the exchange is executed automatically.

The possibility of choosing the purchase or sale price is the main advantage of these sites, and that is why they are chosen by the most advanced traders.

Crypto analysis strategies

Analytical tools to achieve successful investments. How fundamental, technical and network analysis complement each other.

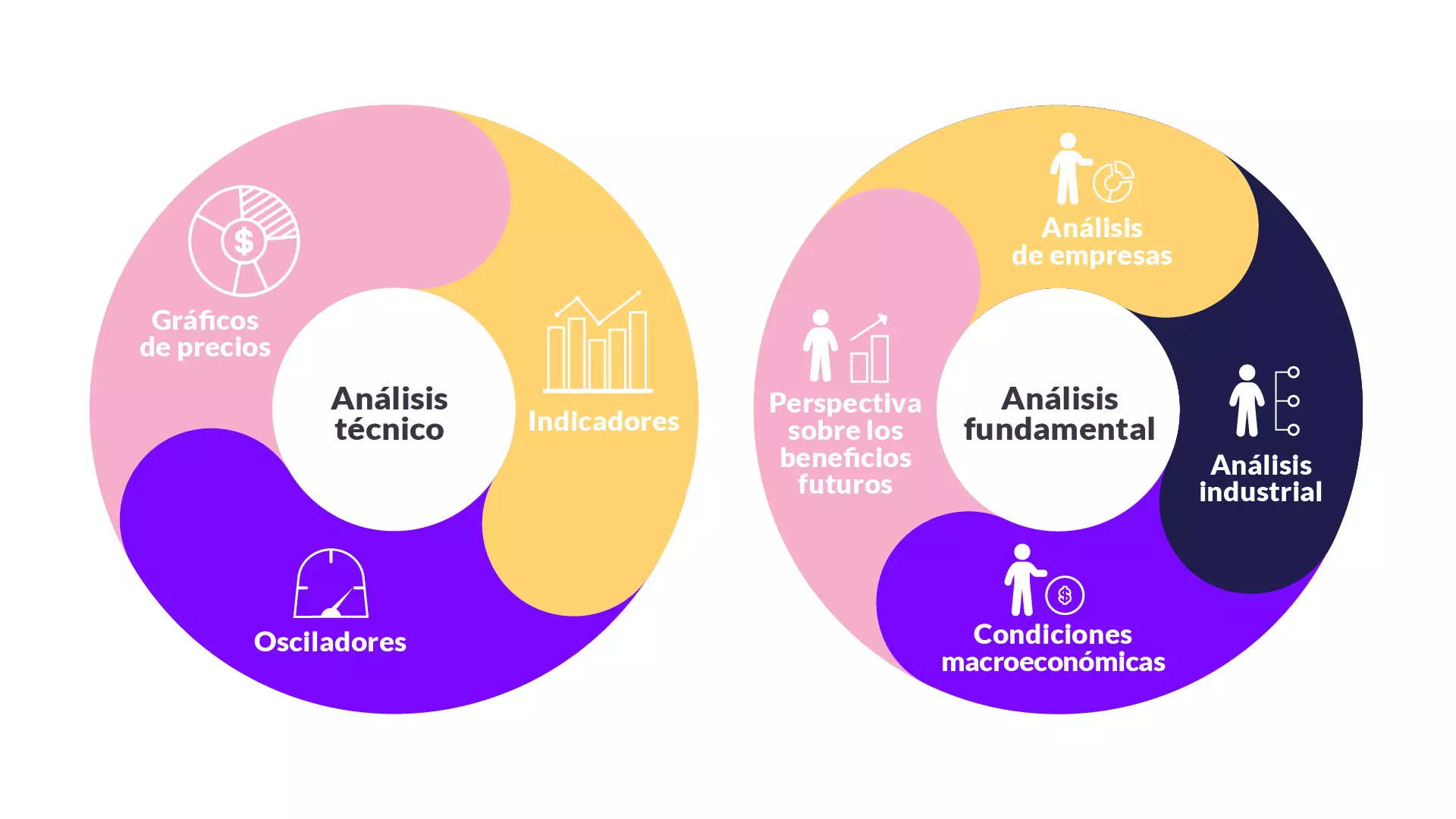

Fundamental analysis

Any investment, whether in cryptocurrencies or stock stocks, requires intense analysis. Knowing what gives value to a stock and what can give it value in the future is vitally important. Investing in bitcoins is also not the same as investing in a cryptocurrency that no one uses. These types of choices can define the difference between a successful investment or a failed one.

First of all, the most important thing is to understand the analysis of the fundamentals of each cryptocurrency. That is, the characteristics that make them unique or that can differentiate them from the rest, giving them their own value.

In the case of BTC, its fundamental characteristics range from being censorship-resistant, decentralized, pseudo-anonymous and fungible to its hard cap of 21 million units. These characteristics make Bitcoin a unique asset. This research should be done with each cryptocurrency in which you are going to invest.

On the other hand, while not strictly an objective metric, adoption is a good metric. This concept has to do with the massive use of a certain cryptocurrency by traditional companies, as well as the use of blockchain in their production processes.

Examples of this are the incorporation of Bitcoin into Cash App, the fiat payment wallet created by Jack Dorsey (CEO and founder of Twitter), the incorporation of cryptocurrencies into Paypal, or the strong corporate investments of Elon Musk’s Tesla.

The various types of analyzes provide complementary information. The more tools you use, the better.

On-chain analysis

In addition to fundamental analysis, it is also necessary to review the information on the usage of each network. As more users participate in a cryptocurrency, its value tends to grow.

There are several tools to investigate each blockchain (for example, Bitcoin) and obtain information.

Some data to take into account are the hashrate (which indicates the number of miners connected to the network), the number of transactions (which gives us an idea of how used it is), the number of active wallets (which can give us an overview of how many users and services there are) and the daily volume of transactions (which is used to measure the total amount of money that a crypto moves in a day).

We can also review the market cap, the total sum of the value of the network, arising from multiplying the price of each unit by the quantity in circulation.

technical analysis

It is a tool to create trading strategies based on market trends. Looking very closely at the up and down charts, we look for past behaviors that are repeated. That is why you have to be careful, since many end up not happening and, with this, the investor can lose money.

Technical analysts use trading data along with mathematical indicators to make their trading decisions. These formulas are automatically overlaid on a chart that updates in real time, which is interpreted to determine when to buy or sell.

This method believes that it is possible to predict the direction of quotes, which made it one of the main tools to try to predict the behavior of financial markets.

The main thing is to choose certain pairs that have good liquidity and a long time since they started trading. The more history the pair has, the more “predictable” its movements are. Then you have to choose the time frame that you want to see reflected in the candles: 1 minute, 1 hour, 1 day… It is also important to choose the indicators and oscillators that interest us the most, without loading the chart too much.

It is important to pay close attention to the resistances and supports, which are the floors and ceilings between which the pair oscillates for a certain time. But also to the volume, which determines the liquidity of a market; and the trend, which indicates, in a more global way, whether the market is falling or rising.